Contents

How to understand and interpret perceptual maps

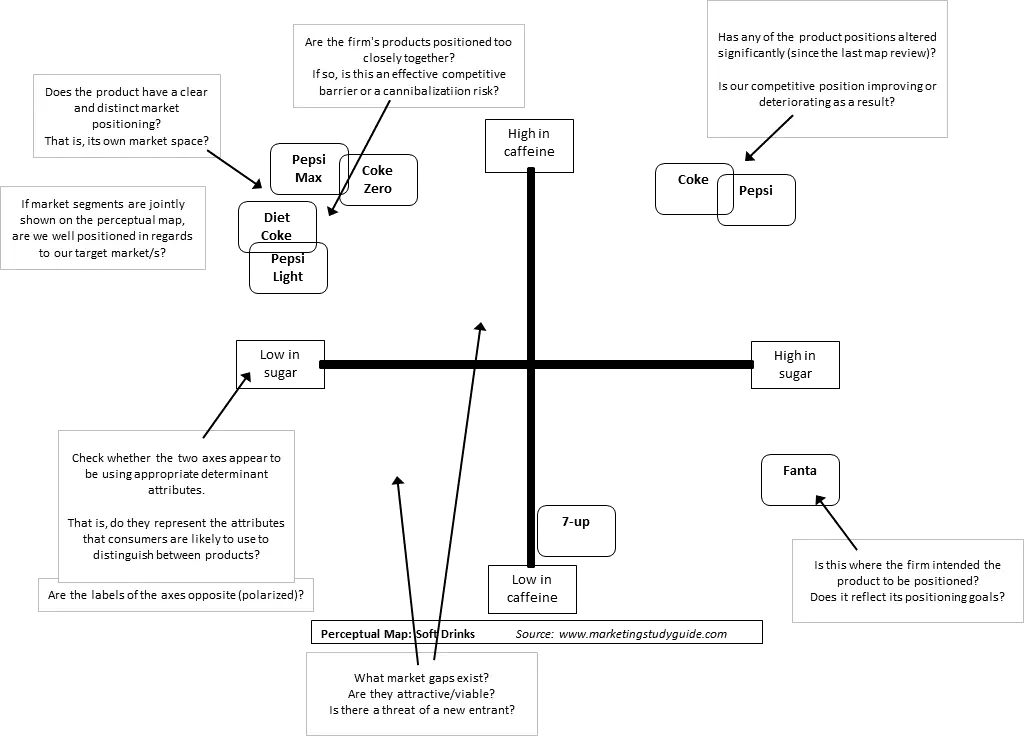

Perceptual maps are designed to provide a visual summary of how consumers perceive the positioning of the different brand/product offerings in the market. In most cases, they are relatively simple to understand and interpret and, perhaps surprisingly, they are able to provide a significant amount of information.

In this below section, we highlight the key aspects to consider when reviewing a perceptual map and work through several examples on a step-by-step basis, using a variety of map formats.

Purposes of a perceptual map

Understanding the different roles of a perceptual map can greatly assist in the interpretation and review process. Let’s quickly relook at why perceptual maps are used (as was presented in the ‘what is a perceptual map?’ section). When presented with maps to review, this checklist should help guide your analysis and conclusions.

| Reason | Discussion |

| Check reality | To see how the target consumers actually perceive the various offerings and positions |

| Impact of campaigns | To measure/track the impact of recent marketing campaigns and any other marketing mix changes |

| Monitor new products | To identify how well any new products have been positioned into the market |

| Monitor competition | To monitor the impact of various competitive offerings over time |

| Look for gaps | To assist the company identify market gap, as an input into the new product development process |

| Understand segments | To provide information that will help further understand different market segments |

| Track preference changes | To track any changes in consumer preferences (and other environmental factors) over time |

What to review on a perceptual map

Using a standard two determinant attribute perceptual map, the following diagram highlights the aspects that should be reviewed (with a discussion following).

(NOTE: To view this diagram more clearly, copy and paste it into a word document.)

What to look for/what to do with a perceptual map

1. Check whether the two axes appear to be using appropriate determinant attributes.

That is, do they represent the attributes that consumers are likely to use to distinguish between products?

2. Are the labels of the axes opposite (polarized)?

This is simply a quick check of the validity of the perceptual map. You would probably do this if the product positions shown on the map did not appear to be logical (from your knowledge of the market).

In some cases, additional maps should be constructed using alternate determinant attributes (which is a common approach). Does the product have a clear and distinct market positioning? That is, its own market space? This is quite important. A key goal of positioning is to be perceived as having a unique offering in the marketplace (that is, some points-of-difference).

For products with strong brand equity, being positioned close to weaker competitors is not much of a problem, whereas weak competitors probably need to reposition slightly to create their own market space.Is this where the firm intended the product to be positioned?

3. Does it reflect its positioning goals?

This is an opportunity to review how the brand/product is really perceived in the marketplace.

Generally you would expect a minor variation between the positioning goal and the actual outcome. It only becomes a problem to be corrected if there is a substantial difference.

4. Are the firm’s products positioned too closely together?

If so, is this an effective competitive barrier or a cannibalization risk? Firms tend to run multiple product offerings in the same target market. In a very competitive market, such as above, a firm with closely positioned products will ‘own’ that area of the market, so this would be considered a competitive strength.

However, if the market had limited/weak competition, then closely positioned products from the same firm would be a weakness.

5. What market gaps exist?

Are they attractive/viable? Is there a threat of a new entrant? There are generally gaps in all markets, but some gaps in cluttered markets are fairly precise.

You need to first consider why there is a gap. Often gaps exist because they are not viable or there is no underlying market need. If a viable gap exists, the firm needs to decide whether this is an opportunity for a new product or assess the threat of a new entrant?

6. Has any of the product positions altered significantly (since the last map review)?

Is our competitive position improving or deteriorating as a result? Trends are important. Over time many market conditions change; we modify our marketing mix, competitors change their offerings, new firms may enter the market, and consumer preferences may change.

By comparing perceptual maps over time, the firm can assess whether their competitive position has improved.If market segments are jointly shown on the perceptual map, are we well positioned in regards to our target market/s?Sometimes a clear/distinct product positioning may be misleading. When market segment preferences are overlaid onto a perceptual map, a different picture of the market may emerge.