How can I create market segments?

There are multiple approaches to creating market segments, from simple “guesswork” to more scientific data-driven techniques. On this website you will find an article that addresses the two main market segmentation tools – namely segmentation trees and cluster analysis. But the purpose of this article is to explore the for/against of a broader selection of market segment approaches.

Main approaches to market segmentation

Let’s start by outlining the main choices you have when you need to construct market segments:

- Using management knowledge, expertise, experience

- Arbitrarily using segmentation bases, or some form of generic market segmentation

- Using a segmentation tree – with or without consumer data

- Using an internal customer database or a formal market research study

- Visual means – using two variables only

- Copying/modeling competitor’s approaches to forming market segments

- Market research firm segments

Using management knowledge, expertise, experience

Utilizing existing management understanding of the marketplace is a very acceptable way of generating market segments – provided a mix of experience managers are used, and provided that the team works towards a new/different segmentation approach (as opposed to their traditional segmentation structure).

The advantages of this approach to market segmentation include:

- It is a very fast, efficient and cost-effective approach, as it can be undertaken in a day or less,

- It should generate “buy-in” and “ownership” from the management team, as they have created the segments,

- The market segments are more likely to be aligned to the firm’s position and approach to marketing strategy,

- It may leverage marketing insights gained by the team over many years of experience.

But there are also numerous disadvantages of this approach, namely:

- There is no statistical basis (at this stage) for the formation of these market segments – so they may/may not be viable (see effective criteria for segmentation),

- The management team is more likely to structure the segments on a fairly generic approach, which may lack insight or competitive uniqueness.

Arbitrarily using segmentation bases

This approach to market segmentation simply involves going through the standard list of segmentation bases, and just selecting one or more bases without any real justification. A common approach here would be to segment the market on an age basis, or on a geographic location basis, or even by light/heavy users.

Please note there is nothing inherently wrong with this approach, and it is probably reasonably widely practiced in the marketing community. Certainly it is an easy, low-cost and fast approach, but can lack any underlying justification or connection to the actual market situation.

Using a segmentation tree – with or without consumer data

Segmentation trees are discussed in another article on this website. The principle of a segmentation tree is to slowly break the market into sets of consumers by applying a different segmentation base one at a time.

These can be constructed with or without consumer data. With the data, the sizes and buying potential of each market segment can be identified. Without the data, the various segments are essentially “guesswork” – however, the data may be applied at a later time to help validate the segmentation structure.

The advantages of segmentation trees are:

- Every consumer in the marketplace is included, as the tree starts with a view of the total market

- Usually multiple segmentation bases will be used – which is always a good approach in order to get a good understanding of each potential target market

- The logic and construction of the market segments is clearly recorded/documented, which allows for the fine-tuning of market segments (through the reallocation of the tree’s “branches” at a later stage)

- If the firm/brand wants to expand into another market segment, then a related “branch” on the tree is often a good option

- Segmentation trees allow marketers to adopt a trial/error approach to initially structuring market segments

The disadvantages of segmentation trees are:

- Not every segmentation base may be appropriate to use in this manner

- It is possible to utilize too many segmentation bases, which can create too many small market segments

A free Excel template to help you build segmentation trees and develop segment profiles is available for download on this site.

Using an internal customer database or a formal market research study

The use of actual consumer data to form market segments is becoming more common, primarily due to the increased availability of the data. Many firms now have some form of customer database that is suitable for marketing analysis – and, likewise, many firms can now implement an online market research survey quickly and easily to capture relevant data. In fact, even marketing students undertaking assignments can also use online surveys to utilize some real data.

Cluster analysis is the statistical technique used to group consumer data points into related “clusters” – which we call market segments (essentially groups of related data points).

Cluster analysis has the advantages of:

- Being able to sort through a large amounts of consumer data,

- Quickly look for similarities across a range of marketing variables,

- Quickly consider different segmentation structural approaches and the use of different bases,

- Provides an output of segment measures for each market segment.

However, there are some limitations with its cluster analysis, which include:

- The marketer needs to know how to interpret some of the output,

- Unfortunately, clustering relies upon access to consumer data – and the more valuable data for segmentation – psychographic and behavioral variables – may not always be available.

Please note that I have a related website that discusses the concept of cluster analysis and provides a free Excel template to practice clustering. Please visit Cluster Analysis for Marketing for more information.

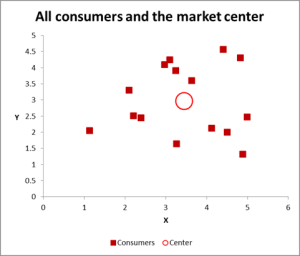

Visual means – using two variables only

If you have access to some relevant consumer data – you can plot the variables onto a scatter chart (two variables at a time) – and you should be able determine potential market segments on a visual basis.

If you have access to some relevant consumer data – you can plot the variables onto a scatter chart (two variables at a time) – and you should be able determine potential market segments on a visual basis.

Take this scatter graph as an example – where two variables (labeled X and Y) are plotted for each consumer (the small red squares) and the average for all the consumers is shown as the larger red circle.

You might be able to distinguish clusters (sets) of consumers – these indicate potential market segments.

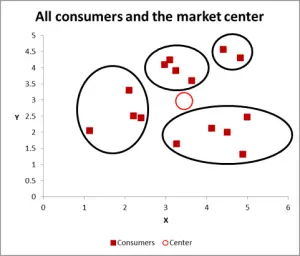

Take a look at the next diagram where an attempt has been made to identify four market segments.

The visual approach to market segmentation is a good approach if you only want to consider two variables.

The visual approach to market segmentation is a good approach if you only want to consider two variables.

You can use Excel to create several of these charts using different variables fairly quickly. And because they are based on actual consumer data, you should be able to construct measures of each segment.

The main disadvantage with this approach is that you are limited to two marketing variables only.

Copying/modeling competitor’s approaches to forming market segments

Quite often aspects of a firm’s marketing strategy and its various promotional campaigns are “borrowed” from a competitor. No doubt you have seen similar TV commercials produced by different firms.

Therefore, the same approach can be used for market segmentation purposes, particularly in a situation of competitive rivalry – where the competing firms look to attack/defend each other.

It is also a good approach for a smaller firm that may not have the need to be overly sophisticated with their approach to segments – so mirroring the approach of the major players should work well for them.

However, it leads to a “me-too” situation unless the marketing strategy is somewhat unique. Therefore, this approach is a poor choice for newer firms and those players seeking to be more innovative in their practice.

Market research firm segments

The final approach to be considered is using the “standard” market segments that have been identified (and studied) by market research firms and other marketing and analytical consulting firms. An example of this – which is commonly found in marketing textbooks – is the Values and Lifestyle segmentation (VALS) approach.

“VALS segments US adults into eight distinct types—or mindsets—using a specific set of psychological traits and key demographics that drive consumer behavior.” – Please see their website for more details.

The main advantages of this approach are:

- The segments have already been identified and tested

- The segments are based on “true” variables that drive consumer behavior

- There is a tremendous amount of supporting data that can be accessed

Obviously the downside of this approach is that many other firms use the same segmentation structure – so if you’re looking to a new way of thinking about the market, this is not for you.

Test Your Knowledge: How to Create Market Segments

Question 1:

Which of the following is a primary advantage of using management knowledge and expertise to create market segments?

A. It provides a statistical basis for segmentation.

B. It is a fast and cost-effective approach.

C. It guarantees innovative and unique segments.

D. It requires advanced market research tools.

Correct Answer: B

Question 2:

What is a key limitation of arbitrarily using segmentation bases?

A. It is time-consuming and expensive.

B. It cannot be applied without consumer data.

C. It lacks connection to the actual market situation.

D. It overcomplicates the segmentation process.

Correct Answer: C

Question 3:

What is the main purpose of using a segmentation tree?

A. To visualize clusters of consumers based on two variables only.

B. To systematically break down a market into smaller segments using different bases.

C. To ensure segments are statistically validated before marketing begins.

D. To mimic competitor segmentation approaches effectively.

Correct Answer: B

Question 4:

Which of the following statements is true about using cluster analysis for segmentation?

A. It can be used without consumer data.

B. It is ideal for analyzing small amounts of consumer data.

C. It groups data points into clusters based on similarities.

D. It primarily relies on visual analysis of scatterplots.

Correct Answer: C

Question 5:

What is a significant disadvantage of the visual segmentation method?

A. It relies on advanced statistical techniques.

B. It requires access to extensive consumer data.

C. It is limited to analyzing only two variables at a time.

D. It cannot identify market gaps visually.

Correct Answer: C

Question 6:

Why might a firm choose to model its segmentation approach on that of a competitor?

A. To ensure their segmentation is completely unique.

B. To avoid the costs of conducting their own segmentation research.

C. To benefit from the competitor’s experience with segmentation.

D. To ensure no “me-too” situations arise.

Correct Answer: C

Question 7:

What is an advantage of using segments defined by market research firms, such as the VALS framework?

A. They provide segments tailored to individual firms.

B. They are based on well-researched variables that influence behavior.

C. They are guaranteed to be unique to your competitors.

D. They eliminate the need for consumer profiling.

Correct Answer: B

Question 8:

What is one benefit of using segmentation trees in market segmentation?

A. They provide access to pre-validated consumer data.

B. They document the segmentation process for future adjustments.

C. They require no input from management teams.

D. They eliminate the need for statistical tools like cluster analysis.

Correct Answer: B

Question 9:

Which segmentation method is best suited for smaller firms seeking to mimic successful strategies of larger competitors?

A. Using segmentation trees.

B. Arbitrarily using segmentation bases.

C. Modeling competitors’ segmentation approaches.

D. Conducting formal market research studies.

Correct Answer: C

Question 10:

What is a limitation of using customer databases for segmentation?

A. It is unsuitable for smaller firms.

B. It relies on behavioral and psychographic data, which may not always be available.

C. It cannot identify measurable segments.

D. It requires visualization tools like scatter plots to interpret data.

Correct Answer: B